One of the biggest surprises of Apple’s March Event came in the form of a new financial project. Building on the success of Apple Pay – a platform that will surpass 10 billion worldwide transactions this year – Apple has decided to take on the banking industry with its very own Apple-branded credit card.

Apple says it wants to improve the credit card system, aiming to shake up an industry that – according to Tim Cook – hasn’t significantly changed for fifty years. The company is partnering with Goldman Sachs and MasterCard to provide the service, which will be known simply as Card.

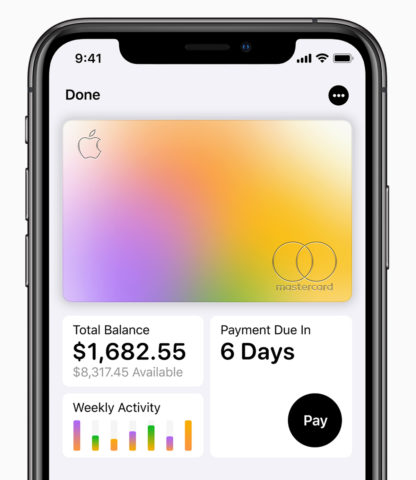

Apple’s credit card will live in your iOS Wallet app, and primarily be used for transactions made with Apple Pay – though users will also receive a physical card for those locations where contactless payments still aren’t accepted. Even the card itself is pretty unique, a laser-etched slab of titanium adorned with nothing but your name. Apple says that storing the card number, CVV, expiration, and signature in the Wallet app instead of on the card itself will work wonders for security, making it much harder for thieves to use your card.

So what else makes this proposition stand out from the countless credit cards already on the market? Well, Apple says it wants to “change the entire credit card experience,” and that starts with registration. The application is quickly handled through the Wallet app with a simple, jargon-free process, and in most cases, you can start using your card immediately. Customer support is handled through the Messages app, so there’s never any need to visit a physical bank or spend hours on hold.

“Apple Card is designed to help customers lead a healthier financial life,” says Jennifer Bailey, Apple’s vice president of Apple Pay. “Which starts with a better understanding of their spending so they can make smarter choices with their money, transparency to help them understand how much it will cost if they want to pay over time and ways to help them pay down their balance.” This means Wallet automatically your spending into neat categories, and can help you adjust your repayment schedule on the fly to help keep costs down.

To further entice users, Apple also promises low interest with absolutely no fees or penalty rates. The message here is that the company wants to get help you out, not to stitch you up at every opportunity. We’ll see exactly what those promises translate to in real terms once the service launches later this year.

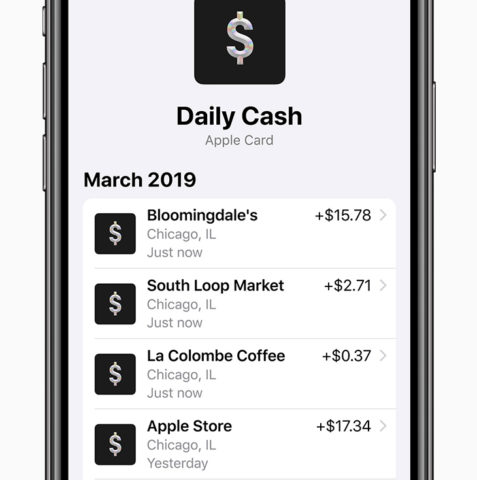

One feature that’s already been explained in detail, though, is Daily Cash. This is an instant cashback service that puts money into your account every single time you use the card. Apple says that it will deposit 3% cashback for purchases from Apple (that covers the Apple Store, the App Store, iTunes, etc.) and 2% cashback on all other purchases made through Apple Pay. Anything paid for with the physical card will be eligible for 1% cashback. It sounds like a decent reward scheme, most notably because there are no hoops to jump through and no waiting around for your money.

As is usual for Apple, strong security and privacy are key selling points of the service. Each device you use with Apple Card will have a distinct card number, and every purchase is secured with Touch ID or Face ID. Apple is keen to assure us that all the spend tracking and recommendations are calculated on-device, so Apple never finds out what you bought, or where, or for how much. Similarly, Goldman Sachs has agreed to never share or sell your data for advertising.

Card will launch sometime this Summer, but for now it will only be available in the United States. Goldman Sachs has said it’s looking into expanding the service to other regions, though we’re a little short on details on that for the time being.

With all the new ways Apple is giving us to spend money, no wonder it’s getting in on the payment side of things!