When the economic outlook is bleak, an app can be your best investment

A global pandemic and the war in Ukraine has knocked the global economy. With corporations cutting jobs and costs going up, it pays to be prudent with your money. Apps can help track spending – but go in with your eyes open.

Figure out whether you need advanced notice of predicted costs/upcoming payments or are happy perusing habits after the fact, and choose apps accordingly. Decide whether you want an automated solution – and if your bank supports apps of that ilk – or one where you’ll mindfully input every purchase, which requires diligence and consistency.

Spend wisely

Be mindful of ‘hidden’ costs. We’re all for paying for quality apps, but you probably don’t want to pay an expensive monthly subscription for a service if you’re counting every buck. Be careful to not make investments in an app either, unless you are 100% certain doing so is the right decision for you. If unsure, get impartial and external financial advice.

With that in mind, we’ve listed 6 user-friendly apps we think could help you track your spending. But also check out your own bank’s app – first-party products increasingly integrate tools to help you understand where your money goes.

6 apps for tracking your money

Emma is available in the USA, UK and Canada. The other apps are available worldwide.

Emma

This financial hub gives you a helicopter view of your finances, through you being able to link it to a range of accounts, including online payment services (such as PayPal) and credit cards. The interface makes it easy to spot how your finances change over time, and simple analytics break down purchases by category – along with listing subscriptions you might prune to make further savings.

There is a paid tier, which allows you to customize categories, export data, and split transactions. And the app includes investment and savings options. Our advice: stick with the free tier, and use it to guide your spending, rather than complicating matters.

Note: If you don’t click with Emma, similar apps exist, such as Mint in the US and Snoop in the UK.

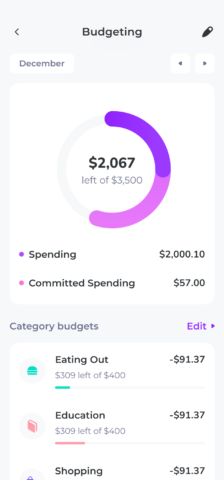

Pennies ($4.99/£4.99)

When automated tracking exists, manually inputting data might feel like hard work, but it makes you aware of what you spend. And Pennies streamlines the process, making it easy to create a budget, assign expenses, and decide if funds should roll over to the next time period.

The app’s ‘budgeting for the rest of us’ nature extends to its interface. It’s bold – and colorful. That might disarm, but it adds another lens for spending, with the background turning red if you burn through funds too rapidly. Given the lowish one-off price, it’s a solid choice to help you better manage money.

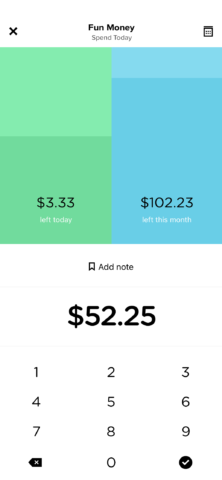

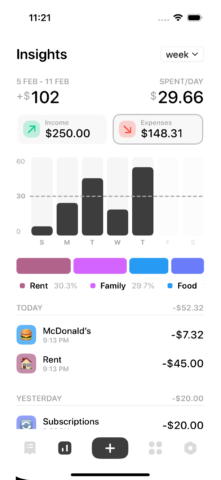

Dime (free)

Given the premium feel, it’s surprising to learn that Dime is free. There are no ads either. What you do get is a swish interface for adding and tracking expenses.

You add and edit categories to suit your needs, each of which can have its own color and icon. Then you tap the + button, add your entry, optionally assign it to a category, and state whether it’s a recurring item.

The insights tab lets you peruse your spending over time, and Dime also lets you set and track budgets. Roll in iCloud sync and you have a full-featured, quality app, yet one that doesn’t cost anything. Do tip the developer, though, if you become a fan!

Spending Tracker (free or $2.99/£2.99)

![]()

Although not as graceful as Pennies and Dime, Spending Tracker is worth considering if you want a free tracker. The app makes it easy to add expenses and assign them to categories. They’re then added to a retro chalkboard that tots everything up and is pleasingly reminiscent of old-school iPhone apps.

Flip your iPhone into landscape view and you get graphs that show where you’re spending your money, and how your cash flow has changed during previous months. All this is generously available for free, with the one-off IAP only being necessary if you’d like to work with repeating transactions and export your data.

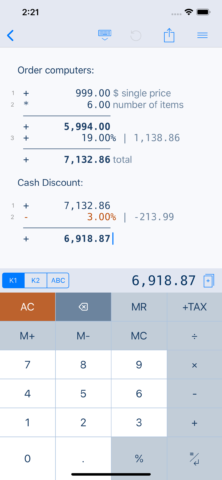

CalcTape ($2.99/£2.99)

In all honesty, this entry exists because we’re pining for notepad calculator Soulver, which is slowly making its way back to iPhone and iPad. CalcTape doesn’t have the same level of functionality, but it does offer a straightforward digital take on ‘back of an envelope’ tracking.

As you use modifiers, you end up creating one long digital paper tape. Each entry can have a note added at the side, for context. And you can opt to have multiple calculations per document. Sadly, they can’t be linked to each other. If you’d prefer something along those lines, the aging Tydlig ($1.99/£1.99) exists – but that also just makes us all the more eager for Soulver 3…

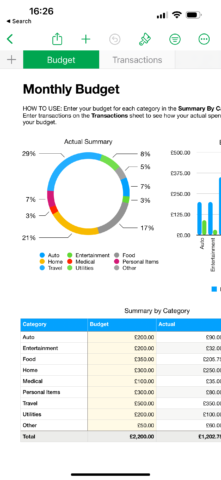

Numbers (free)

CalcTape feels like a brutally simplified spreadsheet, but Numbers is literally a spreadsheet. It’s hugely powerful in terms of the calculations you can make, and you can use it to provide all kinds of visualizations of money management, through converting tables of figures into great-looking graphs.

But because this is a full-fledged spreadsheet app, it lacks friendliness and immediacy. Still, it bundles personal budgeting templates to help get you started, and is ideal for people who live in spreadsheets. So if said templates fit the bill, Numbers isn’t too far from plug-and-play.