Announced in March, and soft-launched to a limited user base earlier this month, Apple Card is now live for all US customers. That means if you live in the US and you’re over 18, you can apply from Apple’s 21st-century credit card right now from your iPhone or iPad.

“We’re thrilled with the overwhelming interest in Apple Card and its positive reception,” said Jennifer Bailey, Apple’s vice president of Apple Pay. “Customers have told us they love Apple Card’s simplicity and how it gives them a better view of their spending.”

Apple Card is partnered with Goldman Sachs as issuing bank, and uses Mastercard’s global payments network to ensure the card is accepted pretty much everywhere. Early critical analysis seems to agree that although Apple isn’t offering the lowest interest rates around, or the highest cashback scheme, it’s pretty competitive in both those fields – and there are no fees to speak of.

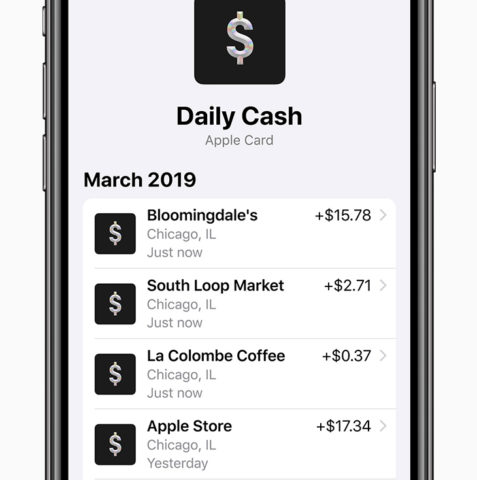

Features like enhanced security, instant cashback, spend tracking, and that gorgeous wordless card are not industry firsts. But as Apple tends to do in so many markets, it has brought together many of the best things from other credit card issuers and combined them into a single slick package.

Perhaps the most notable benefit is how seamlessly everything works together – users can apply and be approved in minutes through the Wallet app in iOS, and keep track of purchases and interest payments in the very same place.

Apple intends to roll out its new credit card to more regions over the next year, but there are no concrete dates yet if you live outside the US.

If you’re a US citizen, however, and you’ve been looking for a decent cashback card that fits perfectly into the Apple ecosystem, look no further. You’ll get 3% back on all purchases from Apple (including apps, games, music, and hardware) and 1-2% on everything else. But we’d advise you don’t apply for the sheer novelty if you don’t need a credit card – that’s a slippery slope!