Very simple budgeting app

Price: Free

Version: 1.0

Size: 1.2 MB

Developer: Bracket Ltd

Platform: iPhone / iPad

Finance and budgeting apps can be a slog. Where some try to make it easier by connecting your bank account and offering layers of features and calculations, new app Oolong goes in the other direction, making things as simple as possible to ensure you don’t get bored and give up. There’s nothing complex here: just a simple manual entry to help project your finances.

At first, this seems like something of a backward step. When apps like this first started hitting the App Store, the work involved in meticulously logging your outgoings, cross-referencing with your bills and all the other fiddly bits made you feel like you may as well just write the dang thing on a piece of paper for all the good modern tech was doing.

However, in 2021, the most powerful apps will connect with your bank account, automatically categorize your outgoings, and help you budget based on real time information. Heck, even the big banks that you might think would be late to the party are stood right over there by the punch bowl with their halfway decent budgeting tools. Elsewhere, you have apps like Chip that use AI to figure out how much you can afford to contribute throughout the month, or Moneybox which rounds up your spending and puts it into savings.

So in this world where you practically don’t need to even think about saving money, what’s the use of an app where you have to manually enter your salary, rent, bills and all the other extras that come with it?

It’s a great question, and luckily one that Oolang is well-versed at answering. It points out users can set things up in just five minutes, rather than an hour of fiddling with account details and manual setup. Though you’ll need to enter things manually each time, the initial barrier to entry is very low. Like the savings app Pennies before it, Oolong hopes that this simple, manual entry will keep you hyper-aware of every single expense without turning you off from actually logging the things.

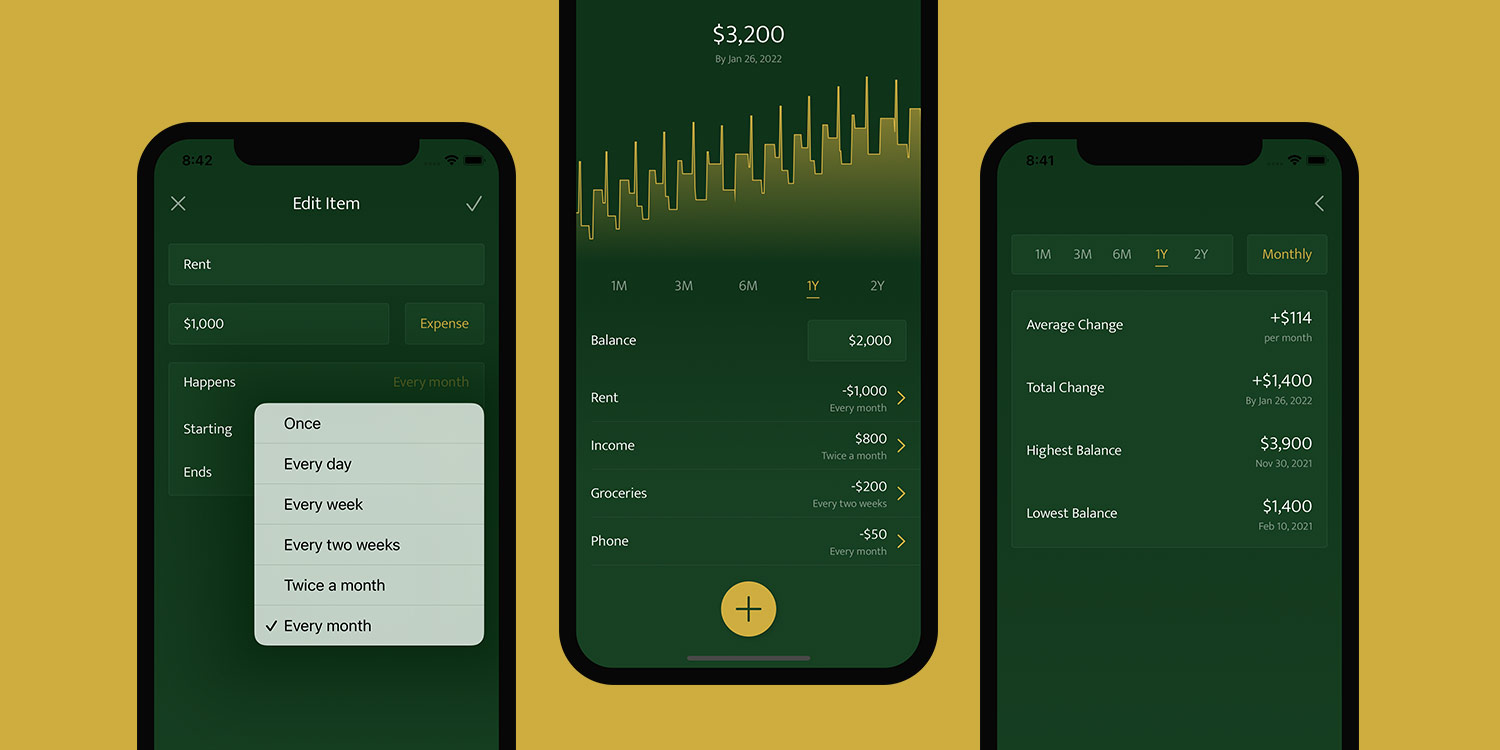

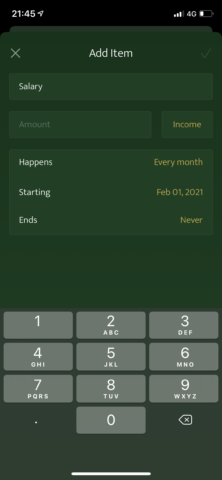

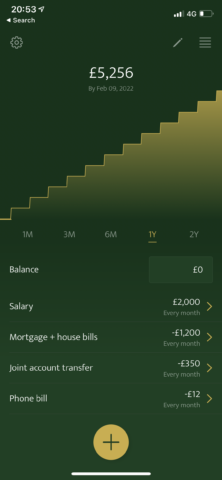

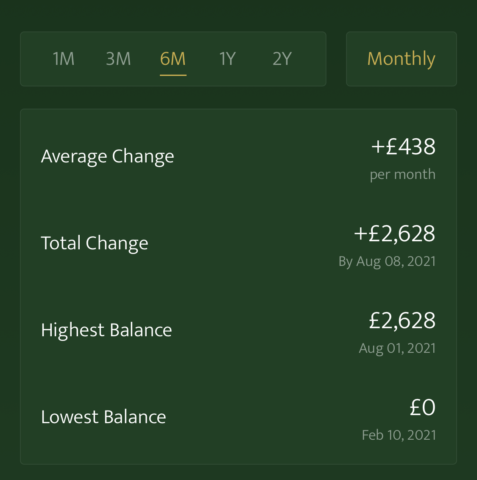

Adding information is easy. To do so, you simply tap the big gold plus sign (the whole app is green and gold which feels like a neat nod to the old fashioned green lamps you see on bankers’ desks), give it a label, an amount and then set the frequency and when it starts or ends. Add your rent, bills and any other ingoings and outgoings and the app will quickly project how much money you will have saved based on the data in 1 month, 3 months, 6 months, 1 year and 2 years.

In some ways, we’re essentially talking about a calculator with a color scheme. There’s nothing here you couldn’t do on a piece of paper or a simple spreadsheet. But that’s not really the point. Oolong has a nice design, works well and is simple enough that anyone can use it.

One amusing moment while testing this app came when a notice appeared at the bottom of the screen saying ‘Looking for a frugal workout?’ We mistakenly believed this to be a feature that might provide advice or additional tools for budgeting. Instead, it took us to an App Store page for the developer’s other app: a high intensity interval training app.

Ultimately, Oolong may find an audience in those that want to keep things simple, don’t wish to bring their bank account details into things, and simply want a quick projection on how much they could save over time. If you want simplicity, then bingo. But others may find it severely lacking features.